SocialFi Done Right: Where you can Short Your Friends

Oct 11, 2024

SocialFi Done Right: Where you can Short Your Friends

Wake up and let’s chat about one of the many features that set Honey Chat apart from the rest: Shorting. With Honey Chat, you have the ability to short your friends—a concept that introduces a novel dimension to SocialFi, uniquely leveraging the mechanics of a bonding curve, which until now has been predominantly used for speculative value increases.

Solving The Price Discovery Dilemma

In the realm of SocialFi, price discovery transcends mere monetary valuation; it's about quantifying the worth of social interactions, content, and influence in real-time.

Dynamic Valuation: Honey Chat allows users to bet on their peers' decline in popularity. This not only enriches the platform with financial strategy but also mirrors the transient nature of real-world social standings.

What is Shorting?

Shorting in the traditional financial world is all about betting against an asset. But here at Honey Chat, we've taken this concept and given it a uniquely social spin. You can now short your friends, or rather, their social capital. Traditionally, this process requires a counterparty from whom to borrow the asset. However, Honey Chat has streamlined this:

How does it work?

Here’s a quick demo video of how it appears within the Honey Chat app. For the mathematically inclined, Bera Grylls explains shorting using Charts and Keys below. He also uses Pictures and Stories for those who (ahem) prefer to digest information via children's parables.

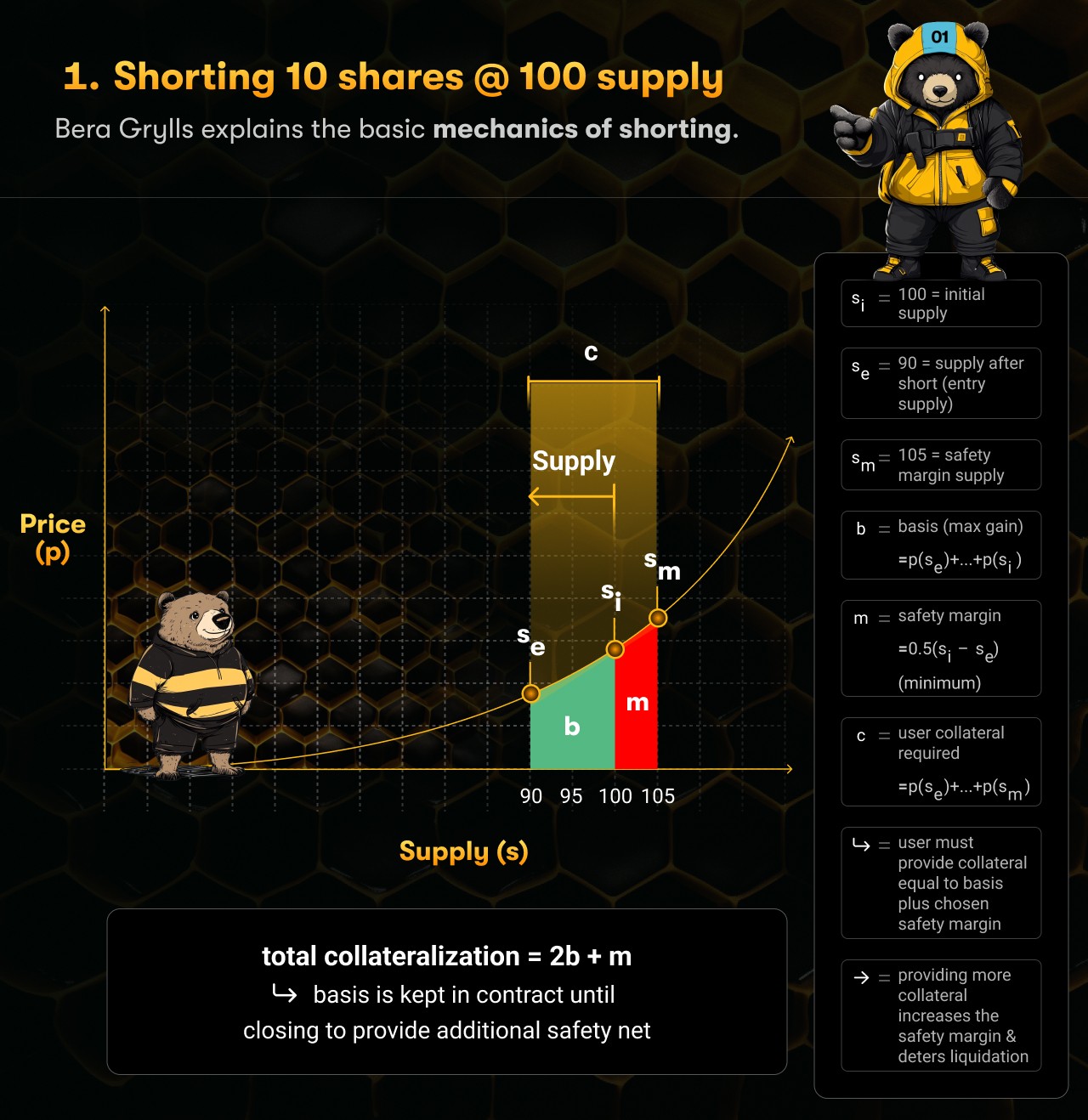

Little Jimmy Bera goes a-shorting:

“In this scenario, Little Jimmy Bera shorts 10 passes with a starting supply of 100 passes. As a result, the supply decreases to 90 passes after his short. Being a bear of very little brain, he sets a minimum safety margin of 5 passes. So he provides collateral for the passes from 90 to 105. If the pass supply reaches 95, Jimmy Bera will be subject to liquidation... and thus. . . rekt-age. He could adjust his safety margin at any time, but he instead chooses to live dangerously.”

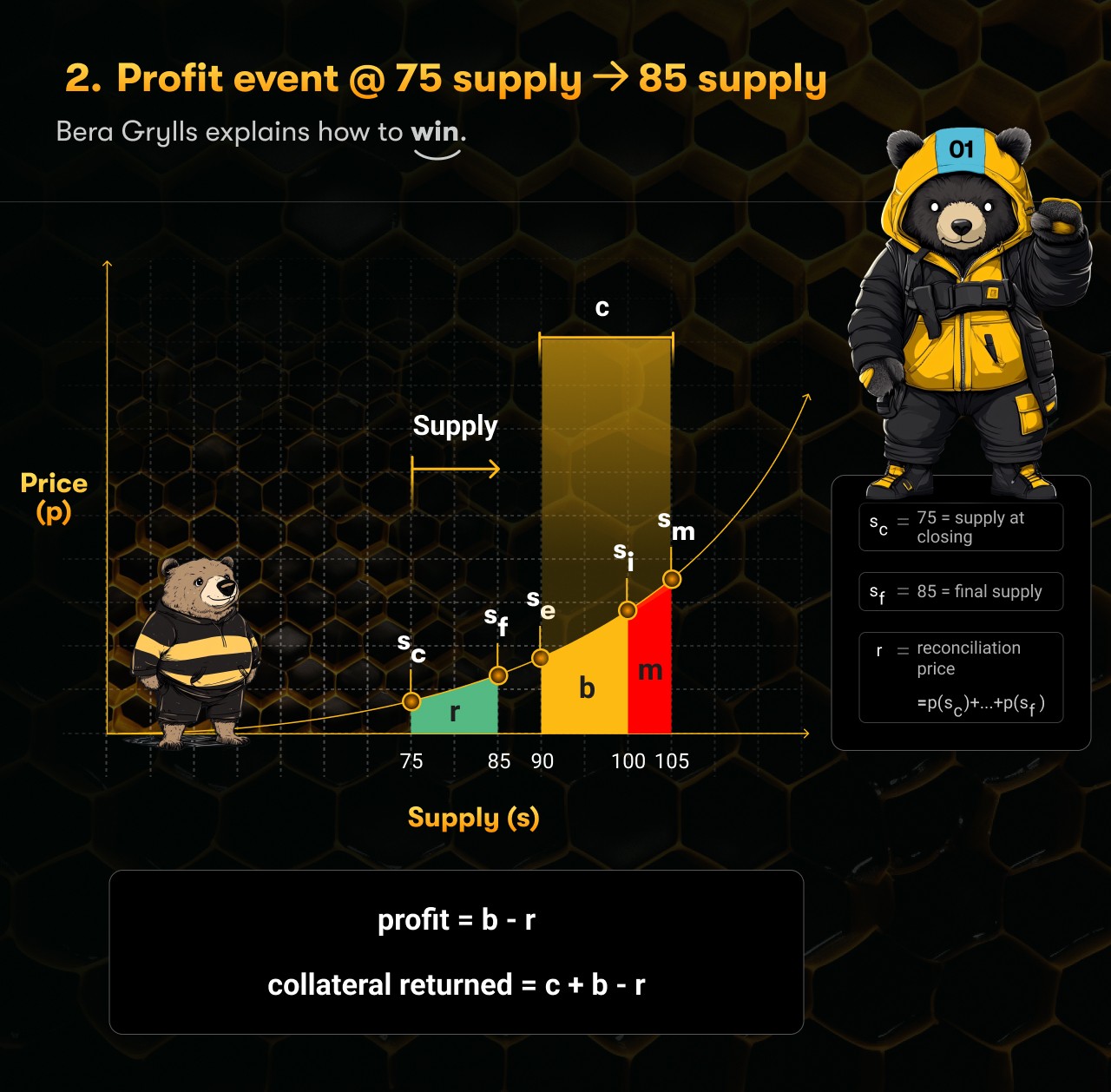

Little Jimmy Bera goes a-winning:

“Here, Little Jimmy Bera decides to close his short after the pass supply has reached 75. His collateral is used to buy back the 10 passes he shorted and the pass supply adjusts to 85. Jimmy Bera receives the full amount of his collateral back plus the original basis of his short minus the cost of the 10 shares he bought back. Little Jimmy Bera swells with pride and social signals his good fortune via a public post.

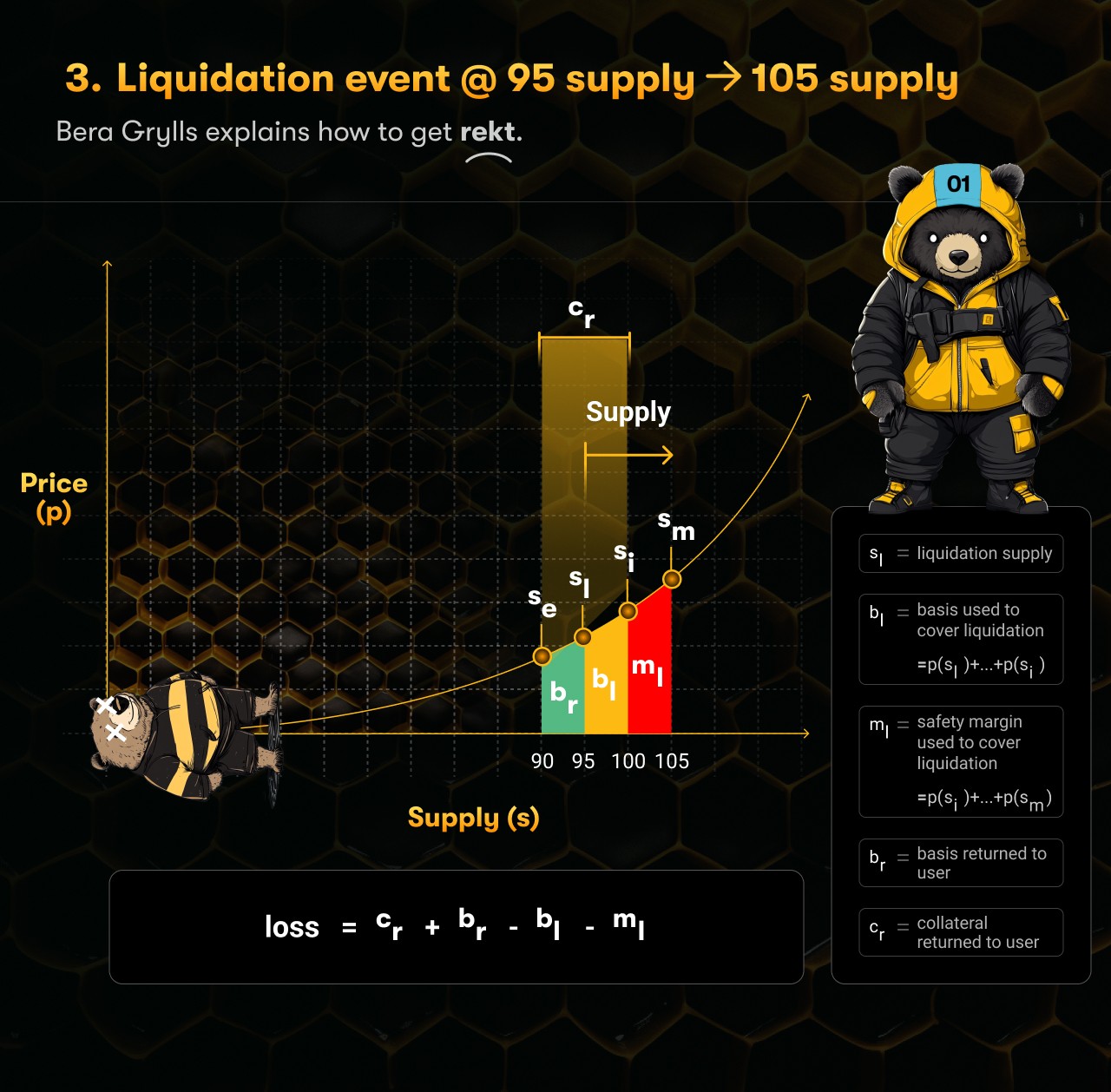

Little Jimmy Bera gets a-rekt (minds outta the gutter; this is for kids):

“Here, Little Jimmy Bera is liquidated after the pass supply rises to 95. With sad little teardrops dampening his face, Jimmy Bera watches as his collateral is used to buy back the 10 passes he shorted and the pass supply returns to 105. Jimmy Bera receives the remainder of his collateral after the amount needed to purchase passes 90 to 95 has been deducted. He numbs his pain by binge watching Cake Boss. It is a sad day for Little Jimmy Bera.”

Conclusion: Redefining Social Value with Shorting

Honey Chat is shaking up the SocialFi scene with its daring introduction of shorting—allowing you to bet on your friends' social downfall with a cheeky twist. This feature adds a layer of financial strategy that mirrors the ever-changing dynamics of real-world social circles. By transforming traditional short selling into a social spectacle, Honey Chat challenges us to not only gain social capital but also to maintain it. In this whimsical blend of Wall Street and high school drama, you can now put your money where your muzzles are and finally tell your friends what you really think!